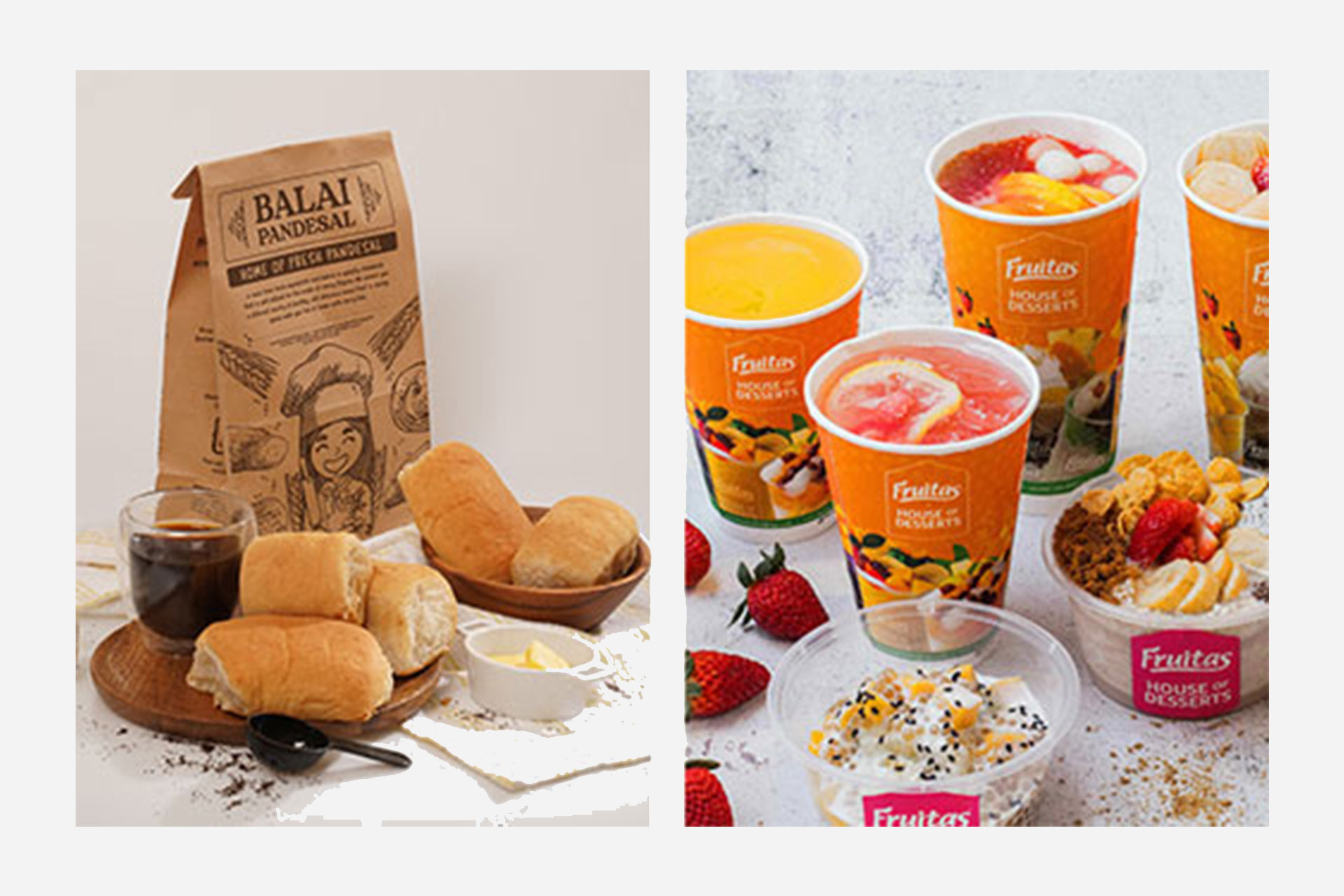

MANILA, Philippines — Balai ni Fruitas Inc., the company behind local bakery brand Balai Pandesal, has secured the green light from the Securities and Exchange Commission (SEC) and the Philippine Stock Exchange (PSE) to proceed with its P309-million initial public offering.

Balai will sell up to 325 million primary shares and 50 million secondary shares with up to 37.5 million overallotment option shares at a maximum offer price of P0.75 apiece. The offer period will run from June 17 to 23 while the target listing date is on June 30.

The final offer price will be determined on June 14 after the company conducts its book building exercise.

“We look forward to welcoming new Balai shareholders to partake in its growth journey. Shareholders of Fruitas will also benefit from the company having a subsidiary gain access to the full range of capital-raising options,” said Balai president and CEO Lester Yu.

The company tapped First Metro Investment Corp. as the sole issue manager, bookrunner and underwriter for the offering.

Since the acquisition of the Balai Pandesal assets in June 2021, the company has expanded to 31 stores from five stores as of Dec. 31 last year with revenues of P148.9 million, a 35 percent increase from the previous year. It swung to a net profit of P8.2 million from a net loss of P0.9 million.

—

Article Reference: https://www.philstar.com/business/2022/05/29/2184397/sec-pse-approve-balai-ipo